Following is from Dr. Housing Bubble discussing how broke FHA is and the ramifications of this on the true health of the housing market:

The bailout of the FHA is making its way here during the holiday season. As we’ve reported many times the FHA insured loan program was essentially a back door program of getting people into homes with ridiculously low down payments. FHA defaults were soaring to record levels as herd mentality buyers were entering markets to compete with flippers, foreign money, and Wall Street investors. Even with low interest rates FHA mortgage insurance premiums increased dramatically but the problems were already too deep. Essentially new buyers were footing the premium for all the nonsense loans made from 2008 onwards. So it should come as no surprise that the bailout is getting closer even though housing prices have gone up.

FHA bailout approaching

When the no-down crap casino loans stopped being made in 2007 the FHA ramped up its loans to all the broke Americans (aka little to no savings) still wanting to pursue the American dream of home ownership:

“(WSJ) The Federal Housing Administration is expected to report this week it could exhaust its reserves because of rising mortgage delinquencies, according to people familiar with the agency’s finances, a development that could result in the agency needing to draw on taxpayer funding for the first time in its 78-year history.”

FHA insured loans were never meant to be such a large part of the market. Even in better times, FHA insured loans were 5 to 10 percent of all mortgage originations. Also, the mission of the FHA was never to finance $500,000+ homes in California. At its core it was a program to help lower income families into modest home ownership. Not a backdoor subsidy of keeping the bubble inflated. Since 2008 they were making up 25 to 30 percent of all loan originations:

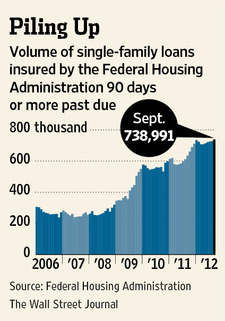

“Though the agency guarantees fewer mortgages than either Fannie or Freddie, it now has more seriously delinquent loans than either of the mortgage-finance giants. Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from a year ago. That represents about 9.6% of its $1.08 trillion in mortgages guaranteed.”

What a shocker. Massive government subsidies to people that can barely scrimp up a 3.5 percent down payment. Here in California that 25 to 30 percent figure also played out since 2008. In other words, in an inflated market people were leveraging up with FHA insured loans just to compete with flippers, Wall Street investors, and big foreign money. Yet the problem is that these people really did not have the ability to handle their loans and that is why the FHA is nearing a bailout. Align this with the Fed and QE3 and you can see that we are still missing the point. People are using massive amounts of debt to make up for lack of savings or actual production. We ran the numbers on a rent versus buy analysis and you can see how strained many in California are when you examine their budgets.

Now people argue that the loans that are going bad now were made in more frothy times. Yet that is the issue even with all the other toxic loans. We have paid for this and will pay for it. Look at the Fed’s balance sheet and you can see where most of the junk loans landed. Banks are still holding on to large mortgages that are in default but are simply not moving on them. The government and banks largely operate in a private-public partnership and ironically the working and middle class have shouldered the biggest part of this burden.

This is what happens when you condition a market to easy money. So now, the market is conditioned on the following:

-Low down payment – step in the FHA

-Low interest rates – step in Fed with QE3

-Investor buying – about 25 to 30 percent of all purchases for the last few years

-Foreign buyers entering frothy markets with hot money

The “organic buyer” is largely a small portion of this other subsidized and hot money inflows. Even with all the bailouts and home prices moving up the FHA is reaching closer and closer to a bailout as we approach a fiscal problem (that is we will need to raise revenues or cut – a combination of the both is more likely). Again, household income growth is weak and all this additional leverage is hiding the fact that things in the economy are still fragile yet the banking system is built on massive debt and we can’t let things go off the rails before Black Friday right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.